ISSN 2369-7938

Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates.

The Transportation Safety Board of Canada's (TSB) sole objective is to advance transportation safety. This mandate is fulfilled by conducting independent investigations into selected transportation occurrences. The purpose of these investigations is to identify the causes and contributing factors and the safety deficiencies evidenced by an occurrence. The TSB then reports publicly and makes recommendations to improve safety and reduce or eliminate risks to people, property and the environment.

The quarterly report has not been subject to an external audit or review.

Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the TSB's spending authorities granted by Parliament and those used by the department. Authorities include amounts granted through the Main Estimates and Supplementary Estimates for the 2016-17 fiscal year and any respendable revenue earned and available for use to quarter end. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

As part of the departmental performance reporting process, the TSB prepares its annual departmental financial statements on a full accrual basis in accordance with Treasury Board accounting policies, which are based on Canadian generally accepted accounting principles for the public sector. However, the spending authorities voted by Parliament remain on an expenditure basis.

Highlights of fiscal quarter and fiscal year to date results

Statement of authorities

The TSB received $29,788,000 in funding through the Main Estimates ($26,267,000 for operating expenditures and $3,521,000 for employee benefit plans). During the second quarter, the TSB received its operating budget carry forward (OBCF) from 2015-16 which represents an increase in authorities of $1,187,000. The TSB has additional statutory authorities totaling $32,000 at the end of the second quarter generated by proceeds from the disposal of surplus Crown assets and its authority to respend revenues as a departmental corporation. These authorities are reduced in the second quarter by a government-wide budget reduction for the Budget 2016 Back Office Transformation of $32,000.

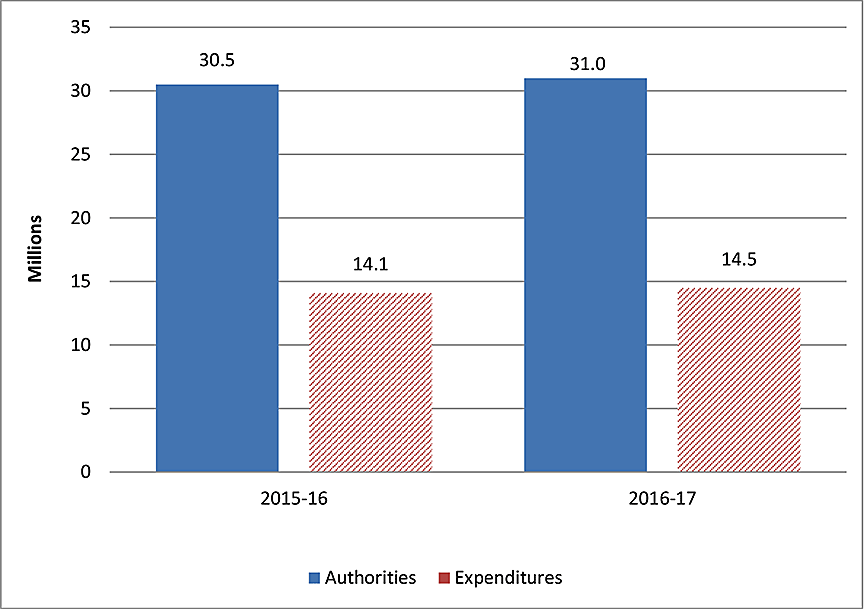

TSB's total authorities available for use increased by $437,000 between fiscal years 2015-16 and 2016-17. This increase is explained mainly by a higher OBCF of $398,000 and an $81,000 increase in Employee Benefit Plan percentage, which is set annually by Treasury Board Secretariat. There was also an increase of $13,000 due to higher respendable revenues earned, which is offset by two government-wide budget reductions: Treasury Board Secretariat Back Office Transformation ($32,000 in second quarter) and Canada School of Public Service Initiative ($23,000 reduced from Main Estimates at beginning of the year).

Statement of departmental budgetary expenditures

The department's year-to-date spending is higher by $351,000 or 2% in the current year compared to 2015-16. This increase is mainly due to TSB's replacement of servers and laptops in the second quarter, as part of the departmental IT equipment useful life replacement schedule.

As illustrated in Figure 1, the TSB has spent approximately 47% of its authorities at the end of the second quarter. This is consistent with expectations given that the department's most significant expense is salaries. The TSB's spending is generally distributed equally throughout the year.

Risks and uncertainties

The TSB is funded through annual appropriations. As a result, its operations are impacted by any changes in funding approved through Parliament. As a departmental corporation, it has authority to spend revenues received during the year although such revenues are minimal; on average less than 1% of the department's funding requirements.

A continuous risk to TSB's financial situation is that expenditures are greatly influenced by the number and complexity of transportation occurrences. A significant transportation accident or a flurry of smaller size occurrences could significantly increase expenditures and result in resource pressures that could require the department to seek additional funding from Parliament.

Moreover, as of 2016-17, all collective agreements are expired. As announced in Budget 2014, departmental operating budgets have been frozen for the past two fiscal years. This presents a risk to the TSB since it will not be allocated any funding for wage and salary increases that took effect during that period, or for the ongoing impact of those adjustments. As a result, the department will need to cover these amounts within its existing appropriations once the collective agreements are ratified and signed. The TSB continues to manage its funding diligently to ensure this risk is mitigated.

Significant changes in relation to operations, personnel and programs

There have been no significant changes in relation to operations, personnel and programs in the current year.

Approval by senior officials

Approved by,

Source document signed by

Kathleen Fox

Chair

Source document dated dated 2016-11-25

Date

Gatineau, Canada

Source document signed by

Chantal Lemyre, CPA, CGA

Chief Financial Officer

Source document dated dated 2016-11-23

Date

Gatineau, Canada

Statement of authorities (unaudited)

| Total available for use for the year ending March 31, 2017 |

Expended during the quarter ended September 30, 2016 |

Year to date used at quarter-end |

|

|---|---|---|---|

| Vote 1 - Net operating expenditures | 27,454 | 6,552 | 12,693 |

| Statutory authorities - Employee Benefit Plans | 3,521 | 881 | 1,761 |

| Statutory authorities - Spending of proceeds from the disposal of surplus Crown assets | 13 | 1 | 1 |

| Statutory authorities - Expenditures Paragraph 29.1(1) of the Financial Administration Act | 19 | - | - |

| Total authorities | 31,007 | 7,434 | 14,455 |

| Budget 2016 Frozen allotment – Back Office Transformation |

-32 | - | - |

| Total authorities available for use | 30,975 | 7,434 | 14,455 |

| Total available for use for the year ending March 31, 2016 | Expended during the quarter ended September 30, 2015 | Year to date used at quarter-end | |

|---|---|---|---|

| Vote 1 - Net operating expenditures | 27,079 | 6,546 | 12,373 |

| Statutory authorities - Employee Benefit Plans | 3,440 | 860 | 1,720 |

| Statutory authorities - Spending of proceeds from the disposal of surplus Crown assets | 5 | - | 1 |

| Statutory authorities - Expenditures Paragraph 29.1(1) of the Financial Administration Act | 14 | 10 | 10 |

| Total authorities available for use | 30,538 | 7,416 | 14,104 |

Statement of expenditures by standard object (unaudited)

| Expenditures: | Planned expenditures for the year ending March 31, 2017 | Expended during the quarter ended September 30, 2016 | Year to date used at quarter-end |

|---|---|---|---|

| Personnel | 25,188 | 6,094 | 12,351 |

| Transportation and communications | 1,521 | 291 | 568 |

| Information | 138 | 50 | 70 |

| Professional and special services | 2,362 | 439 | 688 |

| Rentals | 394 | 62 | 173 |

| Repair and maintenance | 412 | 77 | 132 |

| Utilities, materials and supplies | 230 | 88 | 121 |

| Acquisition of land, building and works | 120 | - | 4 |

| Acquisition of machinery and equipment | 642 | 333 | 348 |

| Sub-total net budgetary expenditures | 31,007 | 7,434 | 14,455 |

| Budget 2016 Frozen allotment – Back Office Transformation |

-32 | - | - |

| Total net budgetary expenditures | 30,975 | 7,434 | 14,455 |

| Expenditures: | Planned expenditures for the year ending March 31, 2016 | Expended during the quarter ended September 30, 2015 | Year to date used at quarter-end |

|---|---|---|---|

| Personnel | 24,863 | 6,381 | 12,326 |

| Transportation and communications | 1,700 | 308 | 565 |

| Information | 160 | 44 | 70 |

| Professional and special services | 2,220 | 429 | 670 |

| Rentals | 339 | 47 | 204 |

| Repair and maintenance | 466 | 94 | 102 |

| Utilities, materials and supplies | 275 | 24 | 74 |

| Acquisition of land, building and works | 115 | 18 | 18 |

| Acquisition of machinery and equipment | 400 | 71 | 75 |

| Total net budgetary expenditures | 30,538 | 7,416 | 14,104 |