ISSN 2369-7938

Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates and Supplementary Estimates.

The Transportation Safety Board of Canada’s (TSB) sole objective is to advance transportation safety. This mandate is fulfilled by conducting independent investigations into selected transportation occurrences. The purpose of these investigations is to identify the causes and contributing factors and the safety deficiencies evidenced by an occurrence. The TSB then reports publicly and makes recommendations to improve safety and reduce or eliminate risks to people, property and the environment.

The quarterly report has not been subject to an external audit or review.

Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the TSB’s spending authorities granted by Parliament and those used by the department. Authorities include amounts granted through the Main Estimates and Supplementary Estimates for the 2018-19 fiscal year and any respendable revenue earned and available for use to quarter end. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

As part of the departmental performance reporting process, the TSB prepares its annual departmental financial statements on a full accrual basis in accordance with Treasury Board accounting policies, which are based on Canadian generally accepted accounting principles for the public sector. However, the spending authorities voted by Parliament remain on an expenditure basis.

Highlights of fiscal quarter and fiscal year to date results

Statement of authorities

The TSB received $30,189,000 in funding through the Main Estimates. During the second quarter, the TSB received its operating budget carry forward (OBCF) from 2017-18 which represents an increase in authorities of $361,000. In the third quarter, the TSB received $249,000 in compensation adjustments from Treasury Board Secretariat, as well as additional funding of $2,978,000 through a Supplementary Estimates A Treasury Board Submission. The amount obtained through the Treasury Board Submission is a permanent annual amount approved by Treasury Board Secretariat, in response to the TSB’s program integrity funding pressures. Furthermore, the TSB has additional statutory authorities totaling $35,000 at the end of the third quarter generated by proceeds from the disposal of surplus Crown assets and its authority to respend revenues as a departmental corporation.

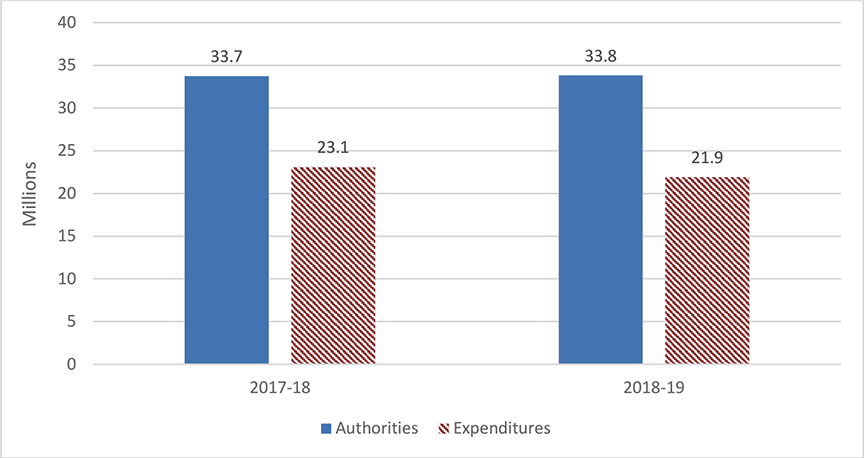

During fiscal years 2017-18 and 2018-19, the TSB received varying amounts of funding for the purposes of collective agreements, OBCF and Treasury Board Submission funding, however, the overall year-over-year difference is only $78,000 at the end of the third quarter.

Statement of departmental budgetary expenditures

The department’s year-to-date spending is lower by $1,187,000 or 5% in the current year compared to 2017-18. This significant difference can be directly attributed to increased salary expenditures for retroactive payments, which were paid out to the majority of the TSB’s employees during the second and third quarters of 2017-18. These retroactive payments were for previous years’ economic increases resulting from recently signed and ratified collective agreements. Salary expenditures in 2018-19 returned to lower levels as almost all of these retroactive payments were settled last fiscal year. Furthermore, in 2018-19, the TSB was able to push forward on the purchases of capital equipment from its capital asset replacement plans, which had been delayed in previous years in order to generate savings and mitigate the risk of the increased salary expenditures that materialized in 2017-18.

As illustrated in Figure 1, the TSB has spent approximately 65% of its authorities at the end of the third quarter. Although this is lower than typically expected at third quarter, the TSB recognizes that this year is unique in that the additional $2,978,000 ongoing funding received through Supplementary Estimates A was received only at the end of the third quarter. As a result, many of the vacant positions could not be staffed during the fiscal year as originally planned. This is anticipated to result in lapsed funds of up to $1,300,000 that will be carried forward to the 2019-20 fiscal year. As the TSB becomes fully staffed in 2019-20, it is expected that lapses and carry forward amounts will be much smaller in future years.

Risks and uncertainties

After a thorough A-base review conducted last fiscal year, it was evident that the TSB did not have enough funding to support its annual ongoing operations, causing the TSB’s program integrity to be at risk. In order to address this serious issue, the TSB worked with the Treasury Board Secretariat to request ongoing funding to resolve the funding shortfall. This request was presented to and approved by Treasury Board and funding was released at the end of the third quarter of 2018-19 therefore alleviating the financial risk to future fiscal years.

A continuous risk to the TSB’s financial situation is that expenditures are greatly influenced by the number and complexity of transportation occurrences. A significant transportation accident or a flurry of smaller size occurrences could significantly increase expenditures and result in additional resource pressures that could require the department to seek further funding from Parliament.

As a departmental corporation, the TSB has authority to spend revenues received during the year although such revenues are minimal; on average less than 1% of the department’s funding requirements.

Significant changes in relation to operations, personnel and programs

There have been no significant changes in relation to operations, personnel and programs in the current year.

Approval by senior officials

Approved by,

Source document signed by

Kathleen Fox

Chair

Source document dated 2019-03-15

Date

Gatineau, Canada

Source document signed by

Luc Casault, CPA, CGA

Chief Financial Officer

Source document dated 2019-03-14

Date

Gatineau, Canada

Statement of authorities (unaudited)

| Total available for use for the year ending March 31, 2019 | Expended during the quarter ended December 31, 2018 | Year to date used at quarter-end | |

|---|---|---|---|

| Vote 1 - Net operating expenditures | 30,053 | 7,257 | 19,472 |

| Statutory authorities - Employee Benefit Plans | 3,724 | 807 | 2,421 |

| Statutory authorities - Spending of proceeds from the disposal of surplus Crown assets | 26 | - | 2 |

| Statutory authorities - Expenditures Paragraph 29.1(1) of the Financial Administration Act | 9 | - | 4 |

| Total authorities available for use | 33,812 | 8,064 | 21,899 |

| Total available for use for the year ending March 31, 2018 | Expended during the quarter ended December 31, 2017 | Year to date used at quarter-end | |

|---|---|---|---|

| Vote 1 - Net operating expenditures | 30,170 | 7,024 | 20,672 |

| Statutory authorities - Employee Benefit Plans | 3,522 | 804 | 2,411 |

| Statutory authorities - Spending of proceeds from the disposal of surplus Crown assets | 27 | 3 | 3 |

| Statutory authorities - Expenditures Paragraph 29.1(1) of the Financial Administration Act | 15 | - | - |

| Total authorities available for use | 33,734 | 7,831 | 23,086 |

Statement of expenditures by standard object (unaudited)

| Expenditures: | Planned expenditures for the year ending March 31, 2019 | Expended during the quarter ended December 31, 2018 | Year to date used at quarter-end |

|---|---|---|---|

| Personnel | 27,489 | 6,530 | 18,673 |

| Transportation and communications | 1,770 | 432 | 1,041 |

| Information | 177 | 22 | 106 |

| Professional and special services | 1,985 | 525 | 975 |

| Rentals | 422 | 69 | 189 |

| Repair and maintenance | 421 | 59 | 191 |

| Utilities, materials and supplies | 424 | 108 | 233 |

| Acquisition of land, building and works | 4 | - | - |

| Acquisition of machinery and equipment | 1,116 | 319 | 487 |

| Other subsidies and payments | 4 | - | 4 |

| Total net budgetary expenditures | 33,812 | 8,064 | 21,899 |

| Expenditures: | Planned expenditures for the year ending March 31, 2018 | Expended during the quarter ended December 31, 2017 | Year to date used at quarter-end |

|---|---|---|---|

| Personnel | 27,689 | 6,787 | 20,393 |

| Transportation and communications | 1,630 | 336 | 896 |

| Information | 148 | 35 | 101 |

| Professional and special services | 2,519 | 321 | 890 |

| Rentals | 453 | 57 | 236 |

| Repair and maintenance | 413 | 130 | 232 |

| Utilities, materials and supplies | 309 | 121 | 215 |

| Acquisition of land, building and works | 63 | - | - |

| Acquisition of machinery and equipment | 510 | 44 | 123 |

| Other subsidies and payments | - | - | - |

| Total net budgetary expenditures | 33,734 | 7,831 | 23,086 |